Financial services software – secure & scalable SaaS

Ideal fintech SaaS platform is a custom one

Imagine your fintech SaaS is built on a platform that is ideally tailored to all your demands — not only adheres to stringent regulations but also ensures scalability, security, and seamless user experiences. For financial services like yours, proper software development is the key to creating solutions that address these unique challenges while standing out in a competitive market.

Generic SaaS platforms often fail to meet the complex needs of financial institutions. From adapting to ever-evolving compliance standards like GDPR and PCI-DSS to handling peak transaction loads and safeguarding against advanced cybersecurity threats, the stakes are exceptionally high. Poorly built sandboxes and inadequate support systems only exacerbate the difficulties, slowing adoption and eroding trust.

In this article, we’ll explore how custom software development empowers FinTech companies to build compliant, secure, and scalable SaaS solutions that cater to the exacting standards of the financial services industry.

How to overcome SaaS pain points with proven scalable solutions

- SaaS tech stack for success in 2025: Expert take + Free tool

- Software development for financial services: Building secure and scalable SaaS solutions — you are here

- Beyond native apps: Why PWAs for SaaS are the future of development

- Elastic, intelligent, invisible: What modern SaaS QA looks like in the cloud

Dire challenges of software development for financial services

Developing a financial SaaS platform can feel like walking a tightrope, meaning a balance between innovation, compliance, and keeping things running smoothly. There’s no shortage of challenges, but they’re all part of the process when you’re building something that needs to be as secure as it is scalable.

Alarming: Regulations are always changing

If there’s one constant in finance, it’s that the rules are always shifting. Whether it’s GDPR, PSD2, or PCI DSS, compliance is a beast of its own. Getting through licensing, managing KYC/AML requirements, and staying ahead of changing standards can feel like a full-time job. And when you’re juggling that with development timelines, it’s easy to see how things can pile up.

Integrations can be tricky

Making sure your platform connects seamlessly with banks, payment gateways, or compliance tools can be an uphill climb. Banks aren’t always quick to collaborate, and when they do, legacy systems or clunky APIs often slow things down. It’s frustrating, but these connections are what make financial SaaS platforms tick.

Alarming: The security pressure is real

Nobody wants to be the platform that gets breached. Fraud detection, real-time monitoring, and data encryption are the concepts every developer in this space must know how to implement. But building those systems takes resources, expertise, and a whole lot of focus. It’s not just about ticking boxes; it’s about making sure your users can trust you with their most sensitive data.

Technology isn’t always on your side

Sometimes it feels like you’re fighting against the tools you’re supposed to be using. Whether it’s dealing with legacy banking systems or struggling to access open banking APIs because of steep requirements, there’s always something in the way. Add in the need for low latency and high availability, and it’s clear that building reliable infrastructure is no small feat.

Alarming: Scalability can be a moving target

Planning for growth is one thing, but keeping things smooth as you scale is another. Handling transaction spikes without downtime means building with the future in mind. And with performance expectations higher than ever, you’ve got to ensure everything — from the smallest function to the largest system — can handle the pressure.

Talent is hard to find

Finding people with the right expertise can be tough. Whether it’s blockchain, AI, or cybersecurity, the demand for top-tier talent is off the charts. Smaller teams often feel the pinch when competing with big players for the same skill sets. Without the right people, innovation tends to slow down, no matter how great the vision is.

It’s not cheap

Building financial SaaS isn’t exactly budget-friendly. Between compliance costs, development expenses, and the push to scale, it’s easy to burn through resources quickly. And when funding is tight or investors expect rapid growth, balancing progress with sustainability becomes its challenge.

Mistake costs are overwhelmingly higher

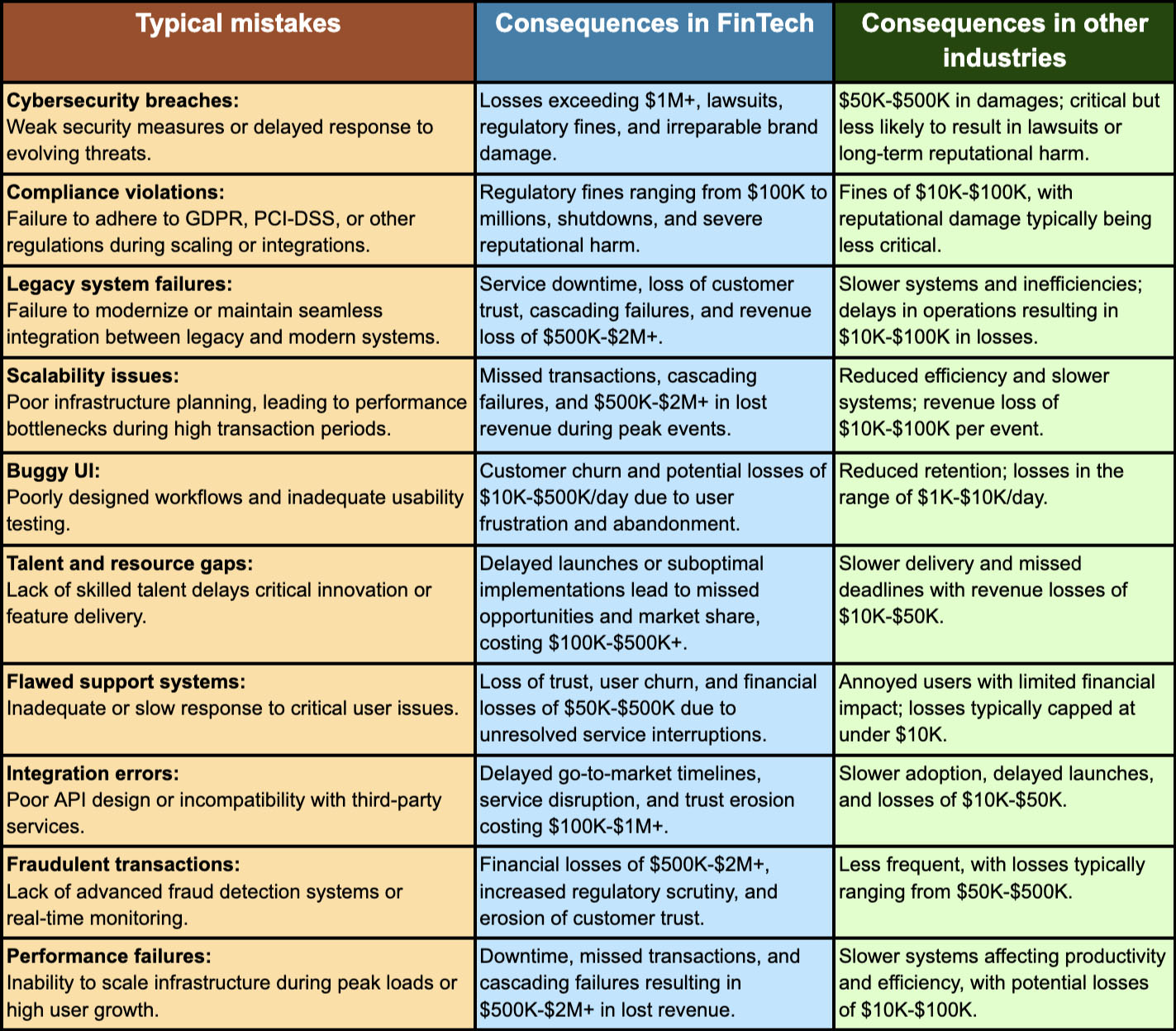

Mistakes in the financial SaaS usually vary from costly to extremely expensive. A minor glitch in a payment system could result in missed transactions worth millions, while a compliance oversight might trigger hefty fines, legal battles, or even the loss of operating licenses.

Unlike other niches, where issues like slow performance or a broken feature may lead to user frustration, in fintech, these can translate to direct financial losses, data breaches, or reputational damage that’s hard to recover from. Below is the comparison table for the main mistakes’ cost in fintech vs. other niches.

Efficient solutions to address the most alarming challenges

Developing financial SaaS platforms means juggling shifting regulations, intense security demands, legacy technology, and the constant need for scalability. Each of these challenges can feel overwhelming on its own, but there are proven, detailed strategies to handle them effectively. Let’s explore practical solutions to address these key hurdles without shortcuts.

Staying ahead of evolving regulations

Regulatory compliance can feel like trying to hit a moving target, but thoughtful planning and the right tools can ease the burden. Here’s how you can integrate compliance into your development process:

- Compliance-by-design. Embed regulatory requirements like GDPR, PCI DSS, or PSD2 into your platform’s architecture from the start. This means integrating encryption protocols, pseudonymization, and data minimization at every touchpoint.

- Example: For a platform targeting EU users, automatic data deletion features ensure compliance with GDPR’s “right to be forgotten” mandate.

- Adopt a global compliance framework. Use modular compliance systems like Scytale to manage multiple regulatory standards simultaneously. This allows you to expand into new markets without rebuilding your compliance infrastructure.

- Example: Scytale’s support for frameworks like GDPR, SOC 2, and PCI DSS makes it easier to meet cross-jurisdictional requirements while maintaining consistency.

- Regulatory sandbox testing. Before launching in a new region, test your platform in a sandbox provided by financial regulators. This controlled environment helps you identify compliance gaps without risking penalties.

- Example: The UK’s Financial Conduct Authority (FCA) offers sandboxes for testing products under real-world conditions while maintaining oversight.

- Automated compliance monitoring. Tools like Vanta or RegScale provide real-time updates on regulatory changes, automate evidence collection, and streamline audits.

- Example: With RegScale, you can track API-level compliance in hyper-regulated sectors like banking or healthcare.

In other words, you should centralize oversight through a dedicated compliance team to stay proactive and avoid the pitfalls of manual monitoring or fragmented efforts.

Building robust security systems

In financial SaaS, security is the pillar. To guard against threats, your platform needs a multi-layered and proactive approach to cybersecurity:

- Zero-trust architecture. Implement a “never trust, always verify” framework where every access request is continuously authenticated. Solutions like Okta handle identity and access management, ensuring users only access what they’re authorized to.

- Example: Use Okta to enforce multi-factor authentication (MFA) and device-based restrictions for all user sessions.

- Behavioral biometrics. Tools like BioCatch analyze user patterns (e.g., typing speed, mouse movements) to detect anomalies in real-time. This prevents fraudulent activities without inconveniencing legitimate users.

- Example: BioCatch flags a user logging in from an unusual location with inconsistent typing behavior, prompting additional authentication before processing a high-value transaction.

- API security standards. Secure API endpoints using frameworks like OAuth 2.0 and tools like Kong Gateway to prevent unauthorized access. Regularly test APIs with Postman or Burp Suite to identify vulnerabilities.

- Example: An API gateway ensures that sensitive payment information is encrypted and accessible only to verified endpoints.

- AI-driven threat detection. Platforms like Darktrace use unsupervised learning to detect real-time threats. By analyzing network activity, these tools can isolate suspicious patterns before breaches occur.

- Example: Darktrace identifies unusual data transfer rates from an endpoint, blocks the activity, and alerts your security team.

- Proactive testing and simulation. Ethical hacking platforms like HackerOne uncover vulnerabilities before attackers can exploit them. Regular penetration tests and simulated attacks keep your defenses sharp.

- Example: A bug bounty program identifies flaws in your API authentication flow, allowing you to fix them before users are impacted.

Scaling without breaking performance

Planning for growth means preparing for unpredictable spikes while maintaining a smooth user experience:

- Cloud-native architecture. Platforms like AWS Elastic Beanstalk automatically adjust server capacity to handle fluctuations, keeping your platform responsive during peak loads.

- Example: Elastic Beanstalk scales up instantly when transaction volumes double during a flash sale.

- Comprehensive load testing. Tools like Apache JMeter simulate high-traffic scenarios to identify potential bottlenecks and weak points.

- Example: JMeter tests how your payment system handles a 500% increase in simultaneous transactions without compromising speed.

- Real-time performance monitoring. Observability platforms like Datadog track latency, resource usage, and error rates, providing actionable insights to optimize performance.

- Example: Datadog identifies high CPU usage on a specific service during peak hours, prompting you to reallocate resources for smoother operations.

All the challenges, sorted and addressed

We've addressed all the fintech development challenges in a single document. This document includes 40 challenges in 8 groups, with both basic and advanced solutions for each group.

You can download it for free and without any extra effort:

Key aspects of high-quality financial SaaS

Kickstarting your financial SaaS platform is just the beginning of your challenge. Along with that, you need to make it reliable, and secure, and give pleasure in terms of customer experience. Let’s be honest, in an industry where trust is everything, there’s no room for cutting corners. Here’s what makes a truly standout financial SaaS solution.

Compliance and regulatory adherence

We all know that compliance is the backbone of financial software. Regulations like GDPR, PCI DSS, and AML standards can feel like a lot, but they’re what keep everything running above board.

The trick is weaving these requirements into the software development process for financial services without making it a constant headache.

That’s why tools that handle automated compliance checks are lifesavers when we speak about Fintech. When you’ve got your compliance game on point, avoiding fines is just s minor part of the game. A much more important thing is building confidence with users, regulators, and partners.

User experience and usability

Nobody wants to wrestle with clunky software, especially when it’s handling their money. A clean, intuitive interface makes all the difference. You want something that feels familiar, even if it’s the user’s first time logging in.

Progressive disclosure — revealing just what you need when you need it — helps keep things simple. And hey, if users can find answers themselves through clear documentation or guided tours, even better.

A little gamification doesn’t hurt either; people love tracking progress or hitting milestones, even with a professional tool.

Robust security measures

Security is the very first thing that makes users trust you with their sensitive data.

Think about encryption as your digital lockbox, protecting data whether it’s sitting on a server or zipping through the web. Layer that with multi-factor authentication and role-based access, and you’re in good shape.

Zero-trust architecture is the next level, keeping every access attempt under scrutiny. And when things inevitably go sideways, a solid incident response plan makes all the difference in bouncing back without losing trust.

Performance and reliability

Nobody notices performance when it’s good, but when it’s bad, you’ll see a lot of unsatisfied users lined up to post negative reviews. That’s why real-time monitoring is a must. It catches issues before users even know something’s up.

Scaling smoothly during a busy day is what separates decent platforms from great ones. Cloud-based systems that flex during high demand keep everything running smoothly, and load testing ensures you’re ready for the unexpected. Reliability is all about having backups for your backups. So when something fails, users don’t feel it.

At the end of the day, high-quality financial SaaS is about building something users can trust, enjoy, and rely on. When you nail compliance, UX, security, and performance, you’re creating peace of mind for your users and yourself.

Best practices for the software development of competitive financial SaaS services

To succeed with financial SaaS, innovative ideas aren’t enough. You need ready-made efficient strategies with a priority of scalability, security, user satisfaction, and innovation.

Multi-tenancy for efficiency

A multi-tenant architecture enables multiple customers to share the same infrastructure while keeping their data secure and separate. This approach optimizes resources and simplifies scaling for diverse user needs.

Microservices framework

Modular, independently scalable components reduce downtime and improve fault tolerance. Updates can be implemented seamlessly without impacting the entire platform.

High availability and disaster recovery

Distributed cloud infrastructure with automated failover systems minimizes downtime during traffic surges or unexpected failures, ensuring a reliable user experience.

Advanced security layers

Use hardware security modules (HSMs) for secure key storage and implement end-to-end encryption for financial transactions. Regular security audits and adherence to standards like PCI DSS and OWASP are critical.

Proactive compliance management

Automate compliance monitoring with tools like RegScale or Scytale to stay ahead of evolving regulations while reducing manual effort.

Fraud detection with AI

Machine learning models can identify anomalies in transaction patterns, enabling early detection of fraudulent activity.

Customizable dashboards

Real-time dashboards that adapt to user preferences help track transactions, budgets, or investments with ease.

Inclusive and accessible design

Features like voice commands, dark mode, and intuitive navigation ensure your platform is welcoming to all users, regardless of their abilities or demographics.

AI-powered customer assistance

Chatbots provide instant answers to common questions, improving response times and freeing up your support team for complex issues.

Automated billing and revenue recognition

Automate subscriptions, invoicing, and renewals to reduce manual errors and improve cash flow.

Real-time data insights

Analytics tools offer actionable insights, such as MRR tracking, KPI dashboards, and cash flow projections, enabling users to make smarter decisions.

Secure banking API integrations

Simplify transactions by connecting your platform to banking systems and payment processors. Offering diverse payment options enhances user trust and convenience.

Agile for speed of your financial services' software development

Short, feedback-driven development cycles let you respond quickly to changing market demands and roll out updates faster than competitors.

AI for predictive insights

Embedded AI can recommend financial products or anticipate user needs based on past behavior, adding value with forward-thinking solutions.

Localization and customization

Tailor your platform to regional needs (tax systems, currencies, and payment methods) to establish your platform as a trusted partner in diverse markets.

Case studies: How we solved fintech issues for our clients

We at Valletta worked with various fintech SaaS projects with the help of smart development, collaboration, and cutting-edge solutions. Here are some of them.

A fintech platform managing 10 requests per second needed scalable infrastructure to handle rapid growth. Inefficiencies in its AWS Cloud Development Kit (CDK) setup were jeopardizing performance.

The solution:

The development team analyzed and addressed issues in the existing Infrastructure as Code (IaC), deployed a scalable AWS environment, and ensured compliance with performance and security standards.

The results:

The platform now operates on a stable and scalable foundation, ready to handle increased traffic and future updates.

A banking client sought a platform for individuals and businesses that combined financial literacy, secure transactions, and an intuitive user experience.

The solution:

A mobile app was developed featuring personalized dashboards, biometric authentication, and financial literacy tools like interactive insights. The design prioritized security and usability.

The results:

The app boosted customer satisfaction, earned a reputation for its user-friendly interface, and became a leader in innovative banking solutions.

A national payment system app experienced NFC payment issues and required biometric authentication alongside a robust security overhaul to improve user trust.

The solution:

Security was enhanced with biometric login and HSM integration, while NFC functionality was debugged and optimized. Dynamic configuration options for default payment methods further improved usability.

The results:

The app’s reliability and security improved significantly, leading to higher user trust and enhanced functionality.

A social trading app faced performance issues, including slow screen rendering and inefficient layouts that caused lags, especially on low-end devices.

The solution:

The team identified undocumented optimizations in NativeScript, reducing screen redrawing times from 1400 ms to just 4-6 ms. Data transfer and query performance were also refined for greater efficiency.

The results:

Performance improved over 200 times, enabling smooth app functionality even on entry-level devices. Users praised the highly responsive interface.

Seller Capital needed an automated system to evaluate more than 100 business markers for its B2B credit line offerings while streamlining workflows and maintaining scalability.

The solution:

An automated client scoring system was developed and integrated with external financial APIs. The architecture supported modularity and scalability to handle future needs.

The results:

Seller application processing time was reduced by 50%, and 80% of workflows were automated, significantly improving efficiency and accuracy.

Conclusion

Embracing the insights shared in this article will unlock a pathway to greater ROI, streamlined operations, and stronger customer loyalty. These are the robust recipes to make your fintech SaaS reliable, future-proof, and market-ready.

Of course, the journey to creating high-quality financial SaaS cannot be easy and requires an experienced partner who’s been there before.

At Valletta Software Development, we’ve worked with industry leaders to deliver tailored, innovative solutions that have redefined the fintech landscape. The track record of our software development for financial services speaks for itself, with measurable results like faster approval times, enhanced user experiences, and scalable systems that adapt to evolving demands.

Delaying action means risking missed opportunities, regulatory penalties, and losing ground in a crowded market. Now is the time to act — before today’s opportunities become tomorrow’s regrets.

So, what’s next? Will you be the one setting the standard for fintech innovation, or will you let others define the future? Let’s create something extraordinary together. Connect with us today and take the first step toward transforming your fintech vision into reality.

Egor Kaleynik

IT-oriented marketer with B2B Content Marketing superpower. HackerNoon Contributor of the Year 2021 Winner – MARKETING. Generative AI enthusiast.

Featured in: Hackernoon.com, Customerthink.com, DZone.com, Medium.com/swlh

More info: https://muckrack.com/egor-kaleynik