AI-Based Fraud Detection System for Payment Transactions

Real-time fraud detection to protect digital payments with adaptive machine learning

Project background

Overview

A European payment service provider approached us with a pressing challenge: the rise in chargebacks and fraudulent activities during online transactions. Their existing rule-based system was unable to keep up with the dynamic patterns of fraud and generated many false positives, slowing down legitimate payments. They wanted an AI-powered system capable of monitoring transactions in real time, improving accuracy, and remaining compliant with financial regulations.

Project Goals

- Detect fraudulent transactions in real time with minimal false positives.

- Automate transaction blocking and escalation processes.

- Reduce financial losses due to fraud by at least 50% within 6 months.

- Maintain PSD2, PCI DSS, and AML compliance.

- Webapp

- 6team members

- 1400+hours spent

- Fintechdomain

Challenges

- Balancing precision and recall in fraud detection to avoid false positives.

- Building a self-improving system that adapts to new fraud patterns.

- Integrating with existing systems without disrupting ongoing operations.

Our approach

Solution

We kicked off with a discovery phase to analyze the client’s historical transaction logs, building a pipeline to preprocess and extract relevant fraud signals. Our data scientists selected a combination of supervised learning and adaptive models that could adjust to new fraud tactics over time. The architecture was designed for low-latency predictions, using AWS Lambda for scalability and Kafka for real-time streaming. We integrated the scoring engine directly into the transaction flow, making it possible to either block or flag transactions for review within milliseconds. Regular retraining and shadow-mode testing were added to ensure model robustness and compliance.

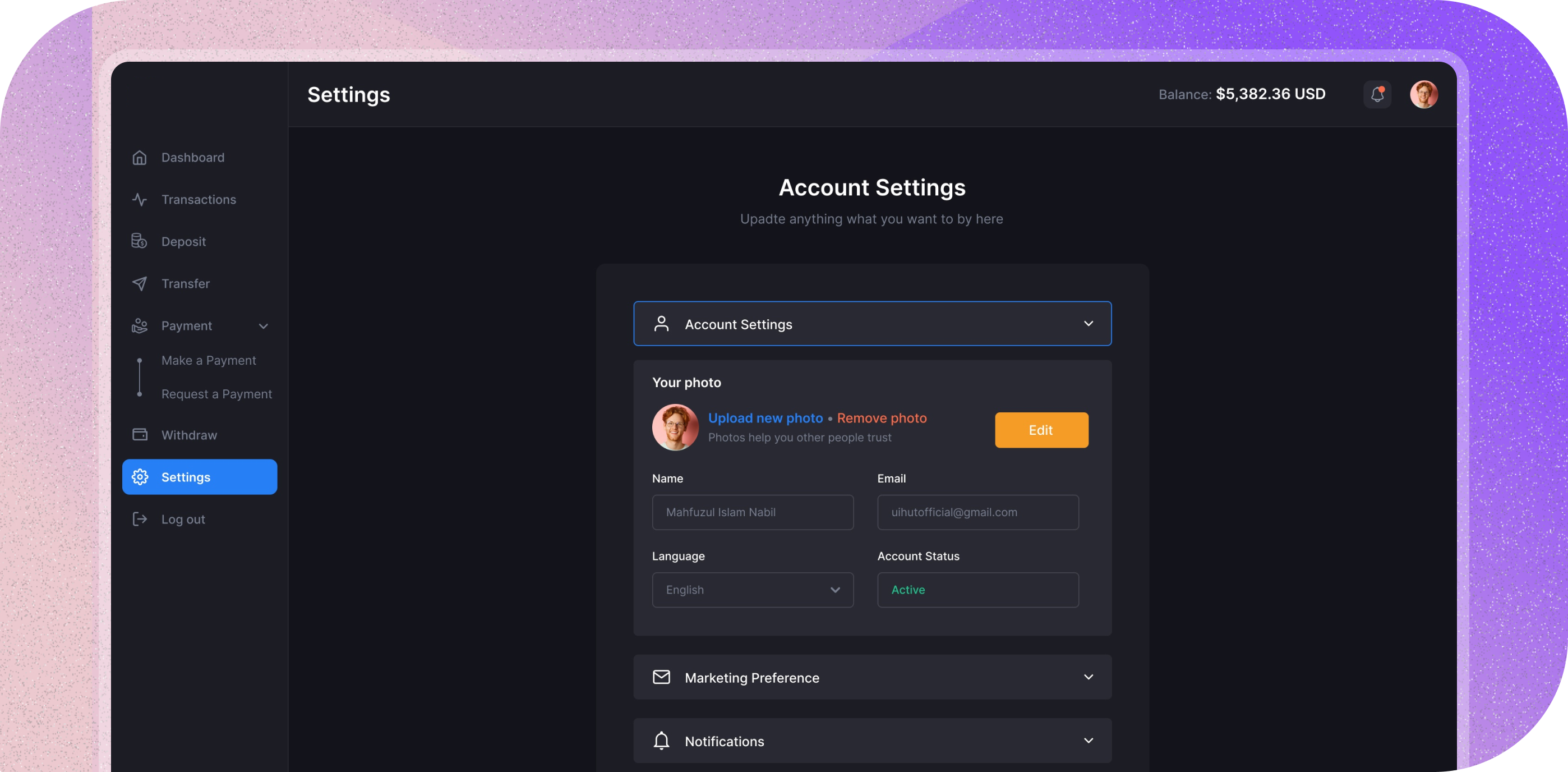

We delivered a real-time fraud detection system based on Python and TensorFlow with XGBoost. Transactions were evaluated through an adaptive scoring engine that combined behavioral analysis, device fingerprinting, and transaction history. The system assigned each transaction a dynamic risk score and either allowed, blocked, or flagged it for manual review. It also provided a dashboard for the client’s fraud analysts, with detailed case history, model feedback loops, and rule-based overrides. The system was deployed using a microservices architecture on AWS, with separate components for scoring, retraining, alerting, and analytics.

Team

The core team included 2 machine learning engineers, 2 backend developers, a frontend developer, and a DevOps engineer. QA and security experts joined the project in the testing and audit phases.

Results

The implementation reduced fraudulent transactions by over 60% in the first six months and lowered the chargeback rate by 40%. The automated risk scoring allowed the client’s security team to focus only on high-risk transactions, improving operational efficiency. Feedback from merchants and users was positive, they noted the absence of friction or delays in the payment flow. The system also helped the client pass a third-party compliance audit and positioned them to expand their service in new EU markets.

The project was highlighted internally by the client as a key driver of their year-over-year fraud reduction success. Within 12 months, the platform processed over 12 million transactions with sub-second scoring latency. The client was able to pitch the new fraud system as a value-add in their enterprise sales pipeline, which led to 3 new contracts with major European retailers.

More Projects

- legal

- dotnet

- webapp

- saas

- python

- webapp