AI Agents for Enterprises: Cut Compliance and Support Costs by 40% Through Autonomous Monitoring and ERP/CRM Integration (2025)

What are AI agents and why do enterprises experiment with them?

AI agents are not just another buzzword, they are autonomous systems designed to act toward goals rather than simply react to commands. Four traits define them: autonomy (they make decisions without constant human input), reactivity (they respond to events in real time), proactivity (they anticipate needs), and social ability (they interact with people and systems around them).

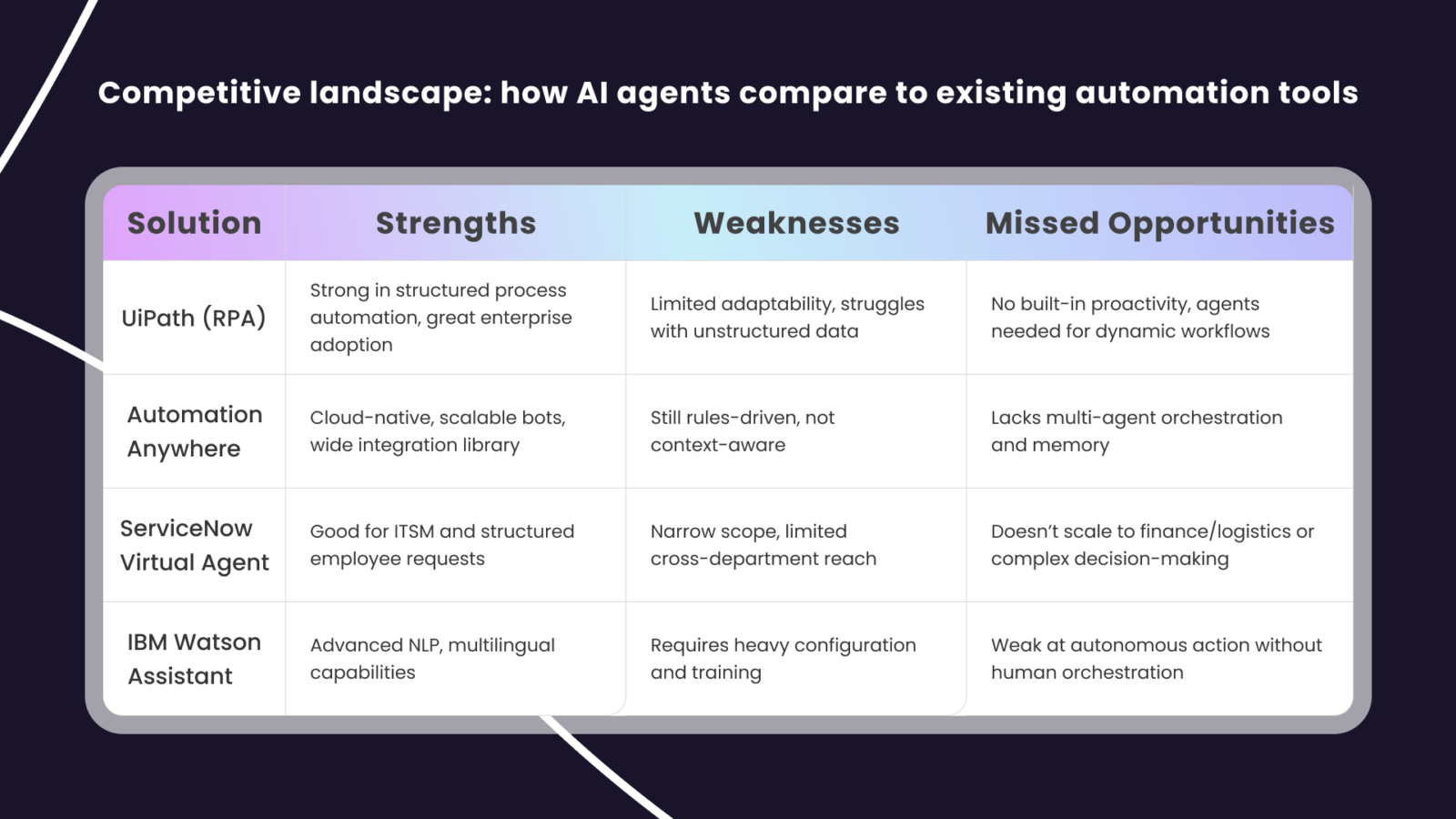

This makes agents fundamentally different from chatbots and RPA. A chatbot can only respond to what a user types. RPA executes repetitive workflows with no flexibility. An AI agent, however, can decide what action is appropriate, adapt if the context changes, and coordinate across multiple enterprise tools.

Yet that very adaptability comes at a price. More autonomy means more oversight. Governance, auditing, and guardrails are required to keep agents safe, compliant, and aligned with business objectives.

Core features that make agents enterprise-ready

Enterprise-grade agents share several capabilities that go beyond academic experiments or consumer tools:

- Goal orientation: they are designed to achieve outcomes, not just complete steps.

- Context awareness: they learn from history and adapt based on current conditions.

- Tool integration: they plug into CRMs, ERPs, and databases, not just chat windows.

- Scalability: they can operate across thousands of tasks simultaneously, 24/7.

Together, these features make agents viable in production environments where reliability and ROI matter.

How agents complement (not replace) classic automation

Enterprises don’t need to throw out RPA or chatbots. Instead, AI agents extend their reach. For example, an RPA bot may handle invoice extraction from PDFs, while an agent monitors anomalies, escalates exceptions, and suggests corrective actions. Chatbots remain useful for structured FAQs, and agents take over when tasks require decision-making and cross-system actions.

The combination provides the best of both worlds: stability where rules are fixed, adaptability where conditions change.

Adaptability vs. governance overhead

Agents deliver flexibility in dynamic business environments, but that flexibility comes with complexity. Each new decision pathway introduces potential risks: hallucinations, compliance gaps, or misaligned actions.

Adaptability speeds up operations and enables automation of tasks once thought impossible, but governance overhead increases. Enterprises must invest in monitoring, explainability, and human-in-the-loop frameworks to manage the risks while reaping the benefits.

Case Study 1: Financial services reduced compliance workload by 35%

In financial services, compliance reporting is a daily burden. Teams spend hours consolidating data from multiple systems, checking regulatory requirements, and preparing audit-ready reports. The process is repetitive, high-stakes, and prone to human error.

We deployed an AI compliance agent designed to automate routine analysis and reporting. The agent continuously monitored updates to regulatory frameworks, pulled relevant data from ERP and CRM systems, and generated draft reports ready for human validation.

As a result, compliance teams reported a 35% reduction in workload and fewer manual errors in filings. This not only freed analysts for higher-value tasks but also improved overall confidence in audit readiness.

Speed and efficiency increased dramatically, but the project required a stronger data governance layer. High-quality inputs, audit trails, and human-in-the-loop checks were essential to ensure accuracy in a highly regulated environment.

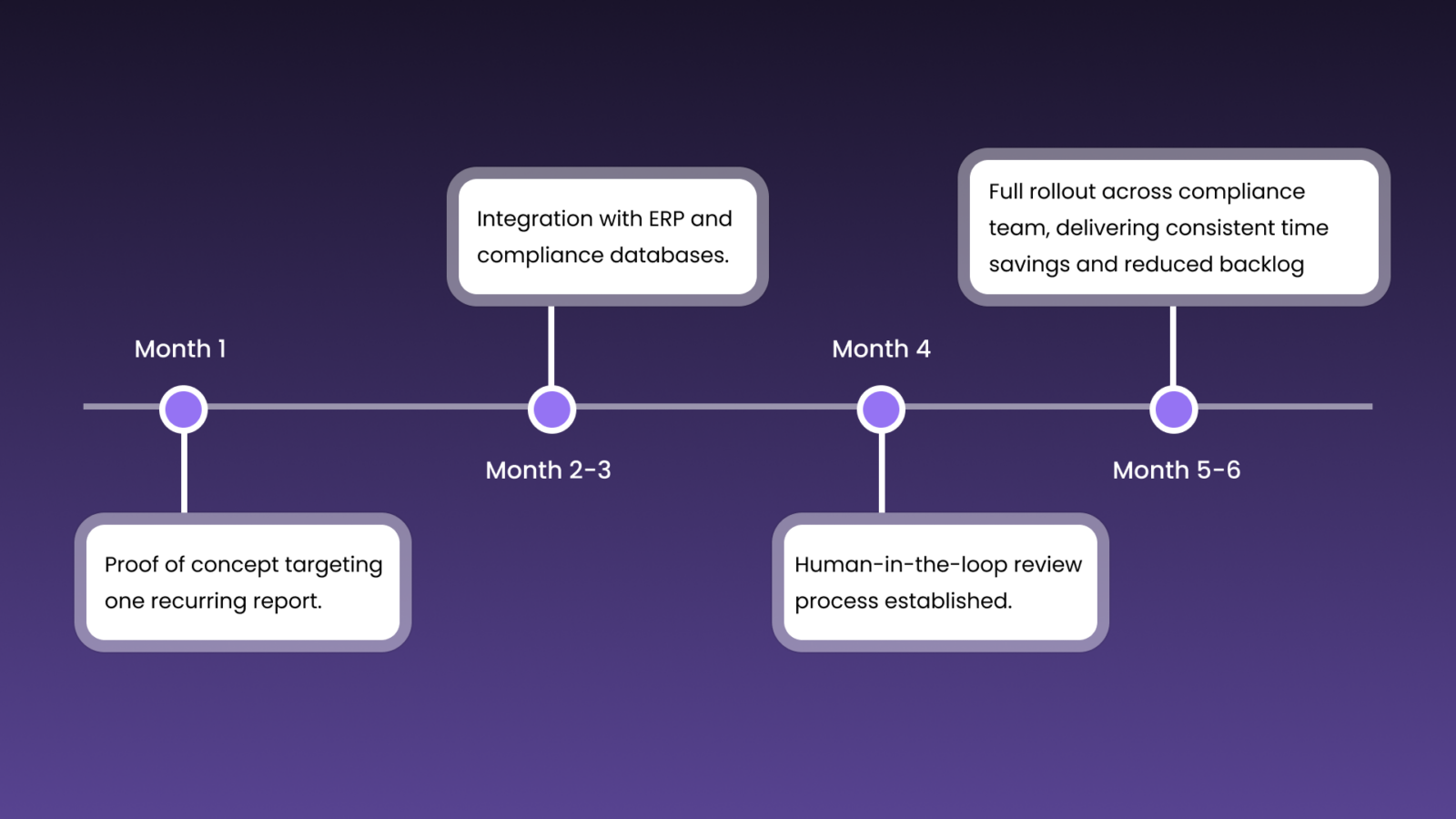

Real implementation timeline (3-6 months)

Challenges: integration with legacy ERP

Legacy systems posed the biggest barrier. The ERP lacked modern APIs, so the integration required custom connectors and additional security validation. This added several weeks to the timeline but was critical to unlock reliable data access for the agent.

Lessons learned: start small with low-risk reports

The key lesson was to begin with low-risk, repetitive reports before scaling to mission-critical filings. Early wins built trust and gave compliance officers confidence in the agent’s outputs. Once validated, the team expanded to more complex and sensitive reporting tasks.

Case Study 2: E-commerce improved customer support efficiency by 40%

E-commerce companies live and die by customer experience. One client faced a surge in support requests driven by seasonal sales, leaving human agents overwhelmed. Tickets piled up, response times slipped, and customer frustration grew.

We introduced a customer support agent that handled triage and automated responses for common requests: order status checks, refund inquiries, password resets. More complex issues were escalated directly to human operators.

Within weeks, the backlog dropped and customer satisfaction scores improved. Overall, the company saw a 40% reduction in ticket backlog and an 18% boost in CSAT. Customers enjoyed faster resolutions, while support staff could focus on cases where empathy and expertise mattered most.

Agents delivered scalability and 24/7 coverage, but edge cases remained a risk. Without carefully designed escalation rules, unusual requests could still frustrate customers. The balance came from letting the agent manage the predictable majority and humans handle the exceptions.

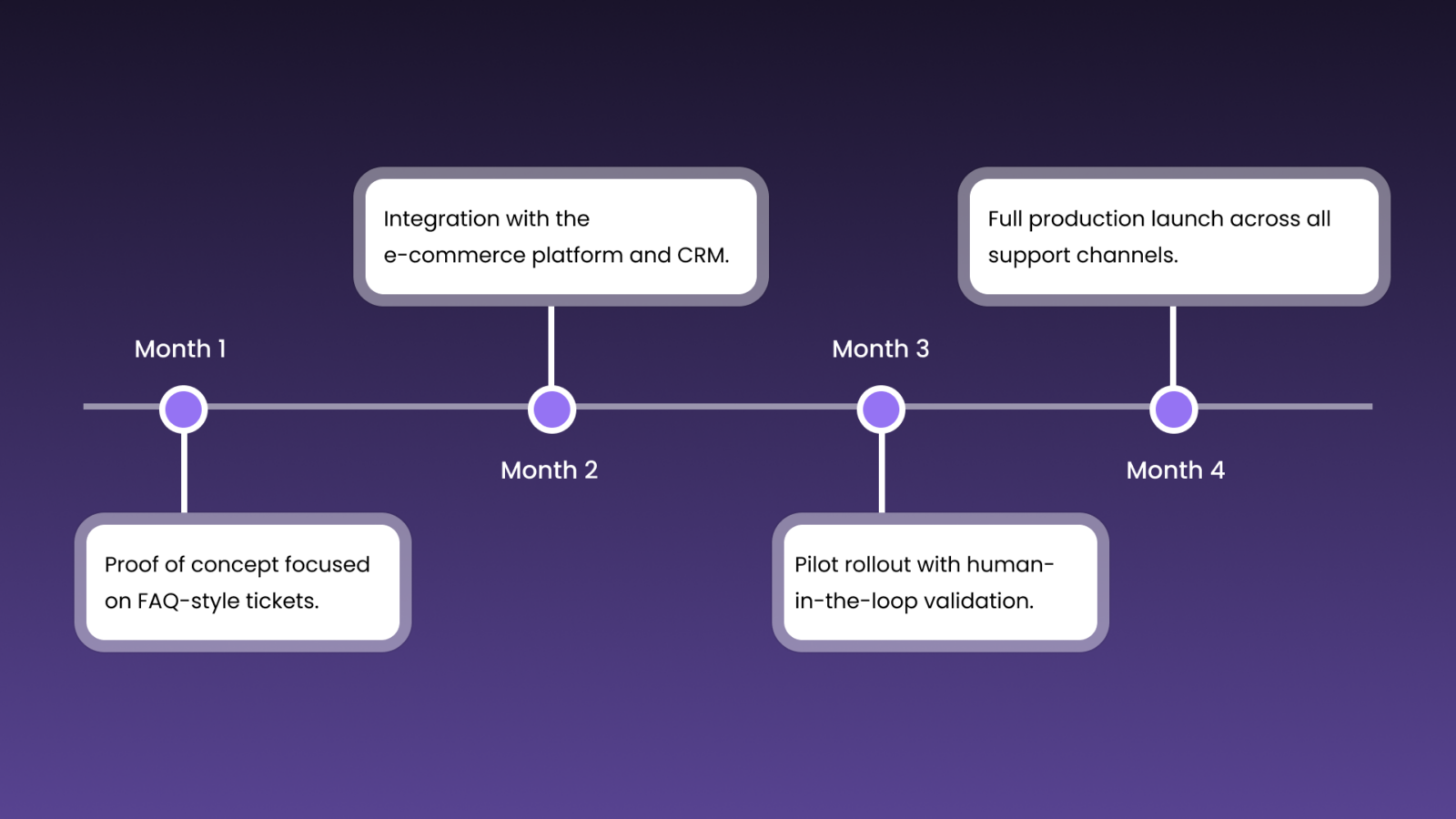

Deployment in under 4 months

Key metrics: backlog reduction and faster response times

- 40% fewer open tickets after the first quarter.

- Average resolution time cut by 50%.

- 18% increase in customer satisfaction (CSAT) scores, tracked via post-interaction surveys.

These results translated into both cost savings and higher customer loyalty.

Lessons learned: escalation rules are critical

The most important takeaway was that escalation design makes or breaks customer trust. Clear rules ensured the agent knew when to hand off to a human. This kept the system efficient without sacrificing the human touch in cases that required it.

Frequently Asked Questions (FAQ)

Enterprises typically see ROI within 6-12 months. Savings come from reduced manual workload, faster throughput, and improved customer satisfaction. In our experience, efficiency gains range from 30% to 40%, with measurable cost reductions in compliance, support, and logistics.

Scaling depends on system readiness, data quality, and governance. Companies with modern APIs and clear workflows can scale in months, while those with legacy systems or fragmented data may take longer. Strong leadership support and change management also accelerate adoption.

The biggest hurdles are connecting to legacy systems, consolidating siloed data, and ensuring secure API access. Some ERPs lack modern connectors, requiring custom development. Enterprises should plan for phased integration, starting with high-value systems like CRM or ticketing, before expanding to more complex environments.

No. AI agents automate repetitive, structured tasks but cannot replace human judgment, empathy, or creativity. In practice, agents complement employees by handling the predictable 70-80% of work, while humans focus on complex, high-value tasks that require expertise and nuanced decision-making.

Strong governance is non-negotiable. Best practices include clear data ownership, lineage tracking, audit logs, and human-in-the-loop checkpoints. Enterprises should enforce policies on data retention, access rights, and validation to ensure agents act within compliance boundaries and deliver reliable outcomes.

Customer support and compliance teams often benefit first, since their workflows are structured and highly repetitive. Sales, marketing, and logistics follow as agents mature and integrate across systems. Starting with one department helps prove value quickly before scaling to others.

The main challenges are coordination, monitoring, and governance. Single agents are easy to track, but dozens of agents require orchestration platforms, unified dashboards, and standardized escalation rules. Without this, scaling risks creating silos of automation rather than enterprise-wide efficiency.

Our platform uses end-to-end encryption, RBAC (role-based access control), tenant isolation, and audit logging. Agents are deployed with zero-trust principles, meaning no action is taken without explicit verification. These safeguards ensure sensitive data remains secure even in multi-agent, multi-tenant environments.

Yes, if deployed with strong compliance frameworks. In finance, agents can automate reporting and fraud monitoring; in healthcare, they handle patient inquiries and scheduling. The key is ensuring GDPR, HIPAA, and ISO requirements are baked into workflows, with audit trails for every decision.

Start small, prove value, and expand gradually. Mid-sized enterprises don’t need massive AI budgets: pilots can begin with focused agents in customer support or finance. The key lesson: invest early in governance and integration, so scaling to new departments is smooth and sustainable.